Table of contents

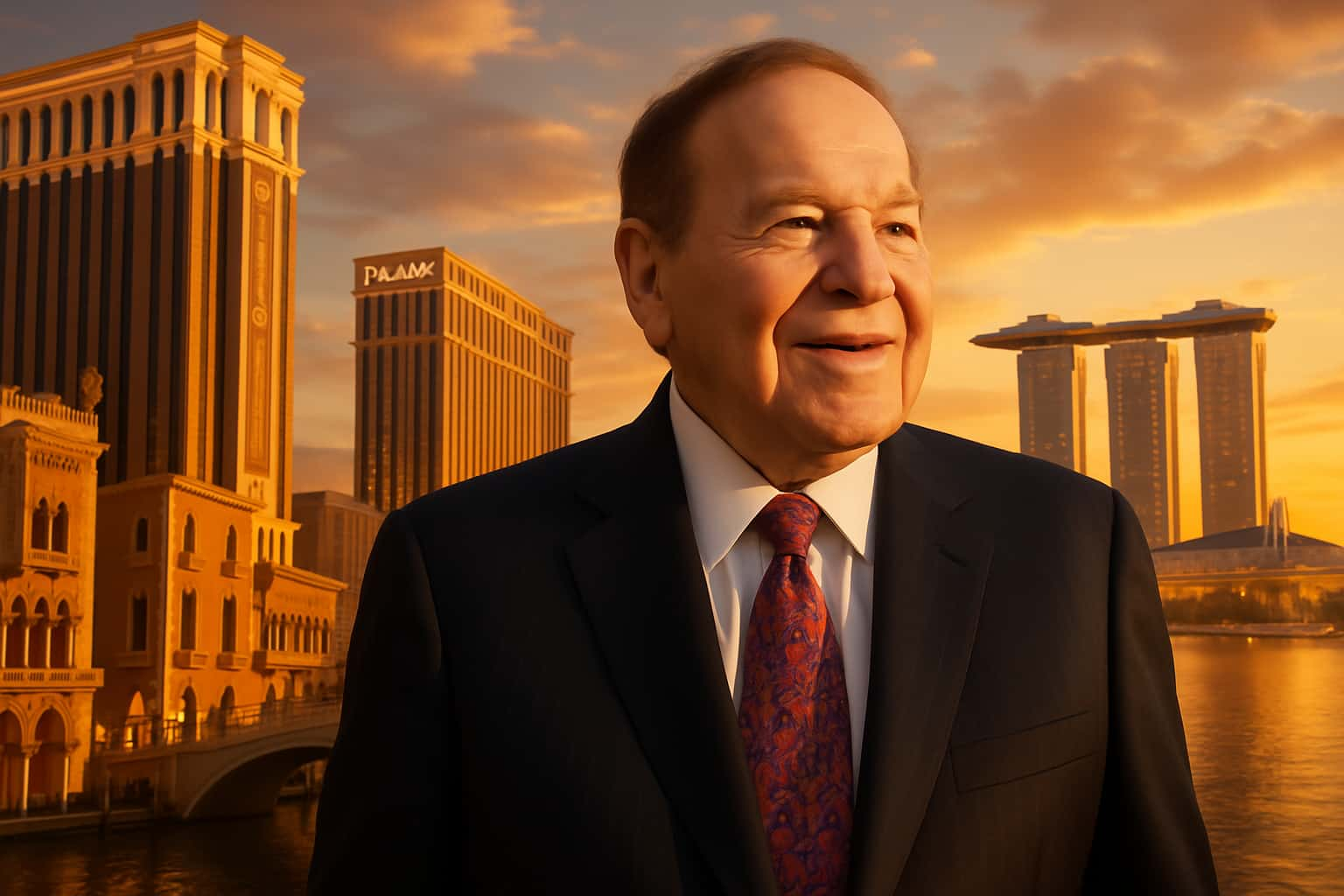

Picture this: a ten-year-old boy stands on a cold Boston street corner in 1943, clutching a stack of newspapers and shouting headlines to passing strangers. His shoes have holes, his coat is too thin for the harsh New England winter, and the $200 he borrowed from his uncle weighs heavy on his young mind. Fast forward seven decades, and that same boy, Sheldon Adelson would own the most expensive building ever constructed, command a $35 billion fortune, and wield enough political influence to move embassies and shape presidential elections.

This is the extraordinary story of Sheldon Adelson, a man who embodied the American Dream in its purest form. Born into poverty in Boston’s rough Dorchester neighborhood, Adelson would rise to become one of the world’s wealthiest individuals, building a casino empire that stretched from Las Vegas to Singapore, while simultaneously becoming the Republican Party’s most powerful kingmaker.

Sheldon Adelson’s journey reads like a masterclass in entrepreneurship, risk-taking, and sheer determination. He created nearly fifty businesses throughout his lifetime, built and lost fortunes twice before his thirties, and ultimately revolutionized not just the casino industry, but the very concept of integrated resort entertainment. His story is one of spectacular triumphs and devastating setbacks, of personal tragedies that would break lesser men, and of an unwavering belief that conventional wisdom was meant to be challenged.

From selling newspapers as a child to constructing the Marina Bay Sands in Singapore—a $5.5 billion architectural marvel that redefined luxury hospitality—Sheldon Adelson’s life proves that in America, the distance between poverty and prosperity is measured not in miles, but in vision, persistence, and the courage to bet everything on your dreams. His legacy extends far beyond business success, encompassing media ownership, political influence, and philanthropic endeavors that touched millions of lives across the globe.

This is the story of how a poor Jewish immigrant’s son became one of the most powerful men in America, and the lessons his remarkable journey offers to anyone bold enough to dream big and work relentlessly to achieve those dreams.

Sheldon Adelson’s Humble Beginnings in Boston’s Dorchester

The story of Sheldon Gary Adelson begins on August 4, 1933, in one of Boston’s toughest neighborhoods. Dorchester in the 1930s was a melting pot of immigrant families struggling to make ends meet during the Great Depression, and the Adelson family was no exception to this harsh reality. His father, Arthur Adelson, had immigrated from Lithuania and worked as a taxi driver, navigating Boston’s streets for meager wages that barely kept the family afloat. His mother, Sarah, had emigrated from England—her father was a Welsh coal miner—and she ran a small knitting shop that provided a modest supplement to the family’s income.

The Adelson household was a study in financial hardship. Arthur would work long hours behind the wheel of his cab, often returning home exhausted and with little to show for his efforts. Sarah’s knitting shop, while a testament to her entrepreneurial spirit, generated barely enough revenue to cover basic necessities. Young Sheldon grew up acutely aware of money’s scarcity and the constant stress it placed on his parents. The family lived paycheck to paycheck, and luxuries were non-existent in their modest home.

But poverty wasn’t the only challenge young Sheldon faced. As a Jewish child in a predominantly non-Jewish neighborhood, he experienced firsthand the sting of discrimination and prejudice. He would later recall being victimized by other children simply for his religious background, an experience that would shape his worldview and instill in him a fierce determination to rise above his circumstances. These early encounters with adversity taught him that success would require not just hard work, but the mental toughness to persevere when others tried to hold him back.

It was against this backdrop of financial struggle and social challenges that ten-year-old Sheldon Adelson made his first foray into the business world. In 1943, with characteristic boldness that would define his entire career, he approached his uncle with a proposition. He needed $200—equivalent to approximately $3,500 in today’s money—to purchase a license that would allow him to sell newspapers on Boston’s busy street corners. For a family already stretched thin financially, this was no small request, but something in the young boy’s determination convinced his uncle to take the risk.

Standing on those cold Boston street corners, hawking newspapers to hurried commuters and busy pedestrians, Sheldon learned his first crucial business lessons. He discovered the importance of location—certain corners generated more sales than others. He learned about customer service—a friendly smile and enthusiastic delivery of the day’s headlines could mean the difference between a sale and a missed opportunity. Most importantly, he learned that success required showing up every day, regardless of weather, mood, or circumstances.

The newspaper business taught him about profit margins, inventory management, and the basic mechanics of commerce. He had to purchase papers from the distributor, find the right locations to maximize sales, and ensure he sold enough copies to cover his costs and generate a profit. For a ten-year-old, these were sophisticated concepts, but Adelson grasped them intuitively and applied them with remarkable success.

By age fifteen, Adelson’s entrepreneurial appetite had grown considerably. In 1948, he once again approached his uncle, this time requesting a loan of $10,000—equivalent to roughly $130,000 today—to start a candy vending machine business. This was an enormous sum for a teenager to request, but Adelson had already proven his business acumen with the newspaper venture. His uncle, perhaps recognizing the young man’s exceptional drive and business instincts, agreed to provide the funding.

The vending machine business represented a significant step up in complexity from selling newspapers. Adelson had to identify high-traffic locations, negotiate with property owners for placement rights, stock the machines with popular candy selections, and maintain the equipment. He learned about route optimization, inventory turnover, and the importance of building relationships with location owners. The business was successful enough to make him a teenage entrepreneur of considerable local reputation.

However, Adelson’s formal education proved less successful than his business ventures. He attended the City College of New York but never graduated, finding the academic environment less engaging than the real-world challenges of entrepreneurship. He also attempted to attend trade school to become a court reporter, but this too ended in failure. The structured, theoretical approach of formal education simply didn’t align with his hands-on, practical learning style.

Following his unsuccessful academic pursuits, Adelson was drafted into the U.S. Army, where he served during the 1950s. Military service provided him with discipline, leadership experience, and exposure to people from diverse backgrounds—all valuable preparation for his future business endeavors. The army also gave him time to think about his next moves and plan his return to civilian entrepreneurship.

Upon his discharge from the military, Adelson immediately returned to what he did best: starting businesses. He established a company selling toiletry kits, recognizing an opportunity in the growing travel industry. When that venture ran its course, he pivoted to De-Ice-It, a business that marketed a chemical spray designed to clear ice from automobile windshields—a practical solution for New England winters that demonstrated his ability to identify everyday problems and create marketable solutions.

In the 1960s, Adelson entered the travel industry by starting a charter tour business. This venture capitalized on Americans’ growing prosperity and desire to travel, offering organized trips to various destinations. The business was successful enough to make him a millionaire, a remarkable achievement for someone who had started with nothing but borrowed money and determination.

However, Adelson’s early career was also marked by spectacular failures. By his thirties, he had built and lost his fortune not once, but twice. These setbacks, rather than discouraging him, seemed to fuel his determination. Each failure taught him valuable lessons about risk management, market timing, and the importance of maintaining sufficient capital reserves. He would later describe these early failures as essential education that prepared him for his eventual massive success.

The COMDEX Revolution That Changed Everything

The late 1970s marked a pivotal moment in Sheldon Adelson’s career, though he didn’t realize it at first. His next venture would transform his fortune and reshape how the technology industry approached trade shows and business networking. Adelson had spent decades running different businesses with mixed success and inconsistent results. He was about to discover an opportunity that would build the financial base for his future casino empire.

The computer industry in the late 1970s was growing rapidly but lacked a central place for industry-wide interaction and showcasing. Manufacturers, software developers, retailers, and professionals had no single venue to share ideas, display products, or do business together. Existing trade shows were too small, too specialized, or limited geographically to serve the booming personal computer market. Adelson, with a sharp eye for unmet needs, recognized this gap as a major business opportunity waiting to be filled.

In 1979, Adelson and a group of partners launched the Computer Dealers’ Exhibition, later known simply as COMDEX. The concept was ambitious: build the world’s largest, most comprehensive computer trade show. Their goal was to unite every part of the fast-changing technology industry under one roof. The first COMDEX was held in Las Vegas, a location choice that would prove to be strategically brilliant.

Adelson’s decision to locate COMDEX in Las Vegas was initially met with skepticism from industry insiders who questioned whether serious business professionals would want to conduct important meetings in a city known primarily for gambling and entertainment. However, Adelson understood something that his critics missed: business people appreciated spectacle, excitement, and memorable experiences. Las Vegas offered world-class hotels, restaurants, and entertainment options that could transform a routine business trip into an extraordinary experience.

“There’s a saying that goes around—Wayne Newton fills the showrooms, Frank Sinatra fills the hotels and Comdex fills the city,” Adelson told the Las Vegas Sun in 1995, reflecting on the show’s impact. “We’re kind of proud of that.” This quote captured not just the scale of COMDEX’s success, but also Adelson’s understanding of how to create events that transcended mere business transactions to become cultural phenomena.

The first COMDEX attracted a modest but enthusiastic crowd of computer industry professionals. However, as the personal computer revolution gained momentum throughout the 1980s, COMDEX grew exponentially. Each year brought larger crowds, more exhibitors, and greater industry influence. By the mid-1980s, COMDEX had become the most important event on the technology industry’s calendar, with major companies timing their product announcements to coincide with the show.

The success of COMDEX demonstrated several key principles that would guide Adelson’s future business ventures. First, he understood the power of creating experiences rather than simply providing services. COMDEX wasn’t just a trade show; it was an annual pilgrimage for technology professionals, a place where careers were made, deals were struck, and the future of the industry was shaped. Second, he recognized the importance of scale and spectacle in creating market-dominating businesses. COMDEX succeeded not just because it was useful, but because it was the biggest, most comprehensive, and most exciting event of its kind.

Throughout the 1980s and early 1990s, COMDEX continued to grow in size and influence. At its peak, COMDEX drew over 200,000 attendees and featured thousands of exhibitors displaying hardware and cutting-edge software applications.

Major tech companies like IBM, Microsoft, Intel, and Apple used COMDEX for key product launches and strategic announcements.

In 1995, Adelson and his partners sold the Interface Group Show Division, including COMDEX, to Japan’s SoftBank Group for $862 million. The deal was one of the largest trade show sales in history and gave Adelson a personal gain of over $500 million. That windfall gave him more than enough capital to fund his next bold business venture.

Selling COMDEX ended an era for Adelson but marked the start of his transformation into a global business mogul. The $500 million from the sale gave him the financial base to enter the competitive and lucrative casino industry. He applied the same principles that made COMDEX successful: create spectacular experiences, challenge norms, and build dominant, large-scale businesses.

Building the Las Vegas Sands Empire

With over $500 million in his pocket from the COMDEX sale, Sheldon Adelson stood at a crossroads in 1995. He could have retired comfortably, invested conservatively, and lived out his days as a wealthy former entrepreneur. Instead, at age 62, when most people are contemplating retirement, Adelson was preparing to embark on the most ambitious and transformative phase of his career. His target: the casino industry, a business he would revolutionize through the same contrarian thinking and spectacular vision that had made COMDEX a global phenomenon.

Adelson entered the casino business in 1988, seven years before selling COMDEX, by buying the Sands Hotel for $110 million. It seemed like a modest investment for someone with his resources and business experience at that point in his career. But Adelson wasn’t interested in simply operating another standard Las Vegas casino like many others on the Strip.

He envisioned a resort combining gaming, luxury hotels, fine dining, entertainment, and—most innovatively—massive convention and exhibition space in one destination.

In 1989, one year after buying the Sands, Adelson made a bold move by building the Sands Expo Center. The 1.2 million square foot facility became the largest privately owned convention center in the United States at the time. It was a massive gamble, and many industry experts were skeptical about the project’s chances of success. Las Vegas already had a public convention center, and critics doubted the city could support two major facilities.

The conventional wisdom in the casino industry held that convention attendees were poor customers for gambling establishments. Business travelers, the thinking went, were focused on work during the day and networking in the evening, leaving little time or inclination for casino gaming. Most casino operators viewed conventions as a necessary evil—something that filled hotel rooms during slow periods but didn’t contribute significantly to gaming revenue.

Adelson’s vision was radically different. He believed that business travelers, particularly those attending large conventions, represented an untapped market for luxury accommodations and high-end gaming. These were successful professionals with substantial disposable income who would appreciate superior service, elegant surroundings, and sophisticated entertainment options. The key was creating an environment that seamlessly integrated business and pleasure, making it easy and appealing for convention attendees to enjoy casino amenities during their stay.

The true test of Adelson’s vision came in 1991 during his honeymoon in Venice with his second wife, Miriam. As they glided through canals and admired the architecture, Adelson had what he later described as a powerful epiphany. He imagined bringing Venice’s romance and grandeur to the Nevada desert, including canals, gondolas, and stunning Italian-style architecture.

This vision became The Venetian, but making it real required a move that shocked the Las Vegas business community. Adelson announced he would demolish the historic Sands Hotel and Casino to build his new mega-resort on the site. The Sands was demolished in 1996, a move both symbolic and practical in the context of Las Vegas evolution.

Symbolically, it marked the end of old Vegas; practically, he needed the full site for his massive development plans.

The Venetian project marked an unprecedented investment in Las Vegas hospitality and signaled a bold shift in resort development strategy. Adelson committed $1.5 billion to construction, making it one of the most expensive resorts in history at that time. The project included 4,049 luxury suites, each much larger than a standard hotel room found elsewhere in Las Vegas. It featured world-class restaurants with famous chefs, a replica of St. Mark’s Square, and singing gondoliers on indoor canals. The shopping areas were designed to recreate the feeling of walking through Venice’s most elegant and historic districts.

Critics were quick to predict failure. The Venetian’s all-suite concept was untested in Las Vegas, where most hotels offered standard rooms at competitive prices. The resort’s emphasis on luxury and sophistication seemed at odds with Las Vegas’s reputation as a destination for middle-class entertainment. Most concerning to industry analysts was the project’s financing structure: Adelson had funded much of the construction through high-yield bonds with interest rates as high as 14 percent, significantly higher than what other casino operators were paying at the time.

When The Venetian opened on May 3, 1999, it immediately became clear that Adelson had fundamentally understood both his market and his critics’ limitations. The resort was an instant success, attracting both convention groups and leisure travelers who were willing to pay premium prices for superior accommodations and unique experiences. The all-suite concept proved particularly popular with business travelers who appreciated the extra space and luxury amenities.

More importantly, The Venetian demonstrated that Adelson’s integrated resort model could generate revenue streams that traditional casinos couldn’t match. Convention attendees did indeed gamble, but they also spent heavily on dining, shopping, and entertainment. The resort’s multiple revenue sources provided stability and growth potential that purely gaming-focused properties couldn’t achieve.

The Macau Goldmine

By the early 2000s, Adelson had proven that his integrated resort model could thrive in the Las Vegas market. But his ambitions reached far beyond Nevada—he saw opportunity in applying the same model to international markets, especially Asia. He noticed growing affluence, more business travel, and rising demand for luxury experiences across many Asian countries and regions. These trends mirrored those that made The Venetian successful, but on a much larger and faster-growing scale. This insight led to investments that transformed him from a U.S. casino operator into a global gaming mogul with immense influence.

Adelson’s expansion into Asia began with Macau, the former Portuguese colony returned to Chinese control in 1999. For decades, Stanley Ho held a government-granted monopoly over Macau’s casino industry, dominating the local gaming scene. In 2002, Macau’s government announced it would open the market to international operators, ending the long-standing monopoly. Adelson immediately recognized this shift as a once-in-a-lifetime business opportunity in a rapidly changing market.

Macau’s potential was staggering, thanks to its strategic location and growing access to wealthy Chinese consumers. Just an hour by ferry from Hong Kong, Macau was easily reachable by Asia’s business and leisure travelers. Unlike Las Vegas, which drew mainly North American visitors, Macau could attract customers from the entire Asia-Pacific region. It was especially well-positioned to serve China, then undergoing unprecedented economic growth and expansion of its middle class.

Adelson’s first property in Macau was the Sands Macao, a smaller project by his standards but revolutionary locally. It opened in May 2004 as China’s first Las Vegas-style casino with luxury amenities and modern gaming experiences. No facility like it had existed in the territory before, making it an instant standout in Macau’s gaming scene.

The Sands Macao’s success exceeded expectations, drawing huge crowds from across Asia starting on its opening day. Visitors came to experience a new kind of entertainment previously unseen in the region. Adelson recouped his entire $265 million investment within one year—an extraordinary return in the casino industry. The performance stunned industry observers and proved the enormous potential of integrated resorts in Asia.

In August 2007, Adelson unveiled his flagship property in Macau: the Venetian Macao Resort Hotel.

Costing $2.4 billion, the Venetian Macao was even more grand than its Las Vegas counterpart. It included the world’s largest casino floor, over 3,000 luxury suites, and globally inspired shopping and entertainment zones. The resort was designed as a full destination, allowing guests to enjoy everything without ever leaving the property.

The Venetian Macao marked a major turning point in Adelson’s career and wealth. When Las Vegas Sands went public in December 2004, Adelson owned 69 percent of the company. As Macau operations soared, his personal wealth multiplied more than fourteen times within just a few years. This explosive growth pushed Adelson into the ranks of the wealthiest individuals in the world.

Singapore’s Marina Bay Sands

While building his Macau empire, Adelson also pursued another major opportunity—this time in Singapore. In May 2006, Las Vegas Sands won one of two prized licenses to develop integrated resorts in the city-state. The bidding process was fierce, with many global competitors, and was considered among the most competitive in casino history.

Adelson’s answer to Singapore’s challenge was the Marina Bay Sands, a $5.5 billion integrated resort project. The building’s design was groundbreaking: three 55-story towers connected by a giant sky deck on the roof. The rooftop featured gardens, fine restaurants, and the world’s largest infinity pool, offering unmatched panoramic views of the city. Marina Bay Sands immediately transformed Singapore’s skyline and became a symbol of the country’s modern, forward-looking global identity.

When Marina Bay Sands opened in 2010, it was the most expensive building ever constructed. The total cost reached S$8 billion, including the price of acquiring prime real estate for development. It surpassed even New York’s World Trade Center towers and Dubai’s Burj Khalifa in total investment size. The scale showed Adelson’s enormous ambition and Singapore’s dedication to becoming a global tourism and business hub.

Marina Bay Sands included far more than a casino—it was a full entertainment and lifestyle complex. The resort housed “The Shoppes,” an ultra-luxury mall with tenants like Ferrari, Chanel, and other elite global brands. It featured multiple pools, including the famous infinity pool, and nightclubs located on specially built artificial islands. There were 2,500 luxury hotel rooms and a convention center, continuing Adelson’s gaming-business-entertainment resort model. A major theater completed the experience, offering cultural attractions along with gambling and luxury accommodations.

Surviving Crisis and Personal Tragedy

The years from 2007 to 2009 tested every bit of resilience Adelson had developed during his extraordinary career. Just as his global casino empire was thriving, he faced a devastating combination of financial crisis and personal tragedy. This period threatened to undo everything he had built over decades of relentless effort, risk-taking, and ambition. How Adelson faced these trials revealed the same strengths that had taken him from poverty to immense prosperity. He showed unwavering belief in his vision, courage to make hard choices, and mental toughness when others might have surrendered.

The 2008-2009 Financial Catastrophe

In fall 2007, Sheldon Adelson stood at the peak of business success and personal wealth. Las Vegas Sands stock approached $150 per share, and Adelson’s net worth soared to $28 billion, according to Forbes. He was the third-richest American and had his sights set on surpassing Bill Gates on the global wealth rankings. With explosive growth in Asia, overtaking Gates seemed like a realistic and achievable goal.

But in September 2008, the financial crisis struck hard, beginning with the collapse of Lehman Brothers. Las Vegas Sands’ stock price began a steep fall, eventually losing over 90 percent of its peak value. Adelson’s personal net worth, heavily tied to the company’s stock, dropped by an estimated $13 billion in months.

Las Vegas Sands was hit especially hard due to its aggressive expansion and significant debt. Ongoing construction in Macau and Singapore required huge capital, but suddenly, credit markets froze and financing dried up. The company had committed to multi-billion-dollar projects but could no longer easily fund their completion as planned.

Adelson faced the real threat of losing his empire but responded with bold, personal action. Instead of declaring bankruptcy or backing away, he and his family injected $1 billion of personal funds into the company. This move showed both his deep commitment and his belief in Las Vegas Sands’ long-term success.

The investment was remarkable for both its scale and what it revealed about Adelson’s values. While many wealthy individuals worked to protect their assets, Adelson risked his fortune to rescue his business and employees. He believed the crisis was temporary and that his resort model would thrive again in a stable economy.

Family Tragedies and Personal Loss

While trying to save his business empire, Adelson also faced personal tragedies that would have crushed many others. The most devastating was the death of his adopted son, Mitchell, in 2005 from a drug overdose at age 48.

Mitchell had struggled with addiction for years, battling cocaine and heroin despite many efforts at treatment and rehabilitation. Adelson, who believed problems could be solved through effort and resources, found himself powerless to save his son. Money, determination, and access to top care weren’t enough to overcome the grip of addiction in Mitchell’s life.

Mitchell’s death showed Adelson the painful limits of control, even for someone used to shaping outcomes with will and wealth. Despite loving support, expensive treatment, and multiple interventions, Mitchell could not recover from his lifelong substance dependence.

Adelson’s heartbreak deepened knowing his other adopted son, Gary, also struggled with addiction issues. Both sons from his first marriage battled dependency, causing ongoing worry that overshadowed even his greatest business achievements. No amount of money or success could ease the pain these family struggles brought into his life.

These losses shaped Adelson’s later political and charitable work, especially regarding drug policy. He became a strong opponent of marijuana legalization, believing cannabis was a gateway to more dangerous and addictive substances. His views clashed with libertarian Republicans who favored reform, but personal tragedy made Adelson resolute in his stance. He refused to support any policy he believed would increase access to drugs that had devastated his family.

The Adelson Legacy – Lessons from a Business Titan

When Sheldon Adelson died on January 11, 2021, at 87, he left more than just immense wealth behind. His $35 billion fortune and global business empire were only part of the legacy he left the world. Adelson’s life was a masterclass in entrepreneurship, resilience, and using vision to reshape industries and global relationships. His journey from poverty to vast wealth offered lessons reaching far beyond business or financial success alone. It revealed timeless truths about human drive, perseverance, and the ability to create lasting change through bold, unwavering ambition.

Key Success Principles

Adelson’s approach to business was characterized by several core principles that remained consistent throughout his career, from his early days selling newspapers on Boston street corners to his later years as a global casino mogul and political kingmaker. Understanding these principles provides valuable insights for anyone seeking to achieve extraordinary success in competitive environments.

The first and perhaps most important principle was Adelson’s willingness to challenge conventional wisdom. Throughout his career, he consistently questioned established practices and sought opportunities that others had overlooked or dismissed. When he decided to hold a computer trade show in Las Vegas, experts predicted failure, doubting professionals would meet in a gambling hub. He later proposed building massive convention centers connected to casinos, but critics claimed business travelers wouldn’t be valuable casino customers. He also invested billions in Asian markets that other U.S. casino operators avoided, and skeptics widely questioned the wisdom of his move.

In each case, Adelson’s contrarian thinking proved to be correct, not because he was lucky, but because he understood market dynamics and customer psychology better than his competitors. His famous quote captured this philosophy perfectly: “You have to go into a business and ignore all the taboos and mores by asking, ‘why and why not?’ Why do people do things in the business the way they do and why not some other way? Of the 50 businesses I’ve been in, I never did it the way people were doing it.”

This willingness to challenge conventional wisdom was closely related to Adelson’s extraordinary appetite for risk. Throughout his career, he consistently made bets that seemed impossibly large to outside observers. The $1.5 billion investment in The Venetian, the $2.4 billion Venetian Macao, and the $5.5 billion Marina Bay Sands all represented enormous financial commitments that could have bankrupted him if they had failed. However, Adelson understood that extraordinary success required extraordinary risks, and he was willing to bet everything on his vision when he believed the potential rewards justified the dangers.

Another key principle was Adelson’s focus on creating experiences rather than simply providing services. From COMDEX to The Venetian to Marina Bay Sands, his most successful ventures were those that offered customers something they couldn’t get anywhere else. He understood that in competitive markets, differentiation was essential, and that the most effective differentiation came from creating emotional connections with customers through memorable experiences.

Philanthropic Impact and Social Responsibility

While Adelson was best known for his business success and political influence, his philanthropic activities represented another important dimension of his legacy. Through the Adelson Foundation, established in 2007, he and his wife Miriam contributed hundreds of millions of dollars to causes related to healthcare, education, and support for Israel and Jewish communities worldwide.

The foundation’s healthcare initiatives reflected Adelson’s personal experience with medical challenges and his belief that advances in medical research could alleviate suffering and save lives. Significant contributions were made to cancer research, addiction treatment programs, and medical facilities in both the United States and Israel. These investments reflected not just charitable impulses, but also Adelson’s business-oriented approach to philanthropy, focusing on initiatives that could generate measurable results and long-term impact.

Political Influence and Policy Impact

Adelson’s political activities represented a unique form of influence that extended far beyond traditional business lobbying or campaign contributions. His status as the Republican Party’s largest individual donor gave him unprecedented access to political leaders and the ability to influence policy decisions at the highest levels of government.

His most significant political achievement was his role in convincing President Trump to move the U.S. embassy in Israel from Tel Aviv to Jerusalem, a decision that fulfilled a long-standing goal of pro-Israel advocates and demonstrated the extent of Adelson’s political influence. This policy change, which had been discussed by American politicians for decades but never implemented, became reality largely due to Adelson’s financial support and personal relationship with Trump.

The scale of Adelson’s political contributions—more than $500 million over his lifetime—represented a new model of political influence that raised important questions about the role of wealthy individuals in democratic societies. Supporters argued that his contributions represented legitimate political participation and that his success in business qualified him to influence policy decisions. Critics contended that such massive contributions gave wealthy individuals disproportionate influence over political processes and policy outcomes.

Business Innovation and Industry Transformation

Adelson’s influence on the casino and hospitality industries went far beyond the success of his own companies. His integrated resort model—combining gaming, conventions, luxury hotels, fine dining, and entertainment—became the global standard for casino development.

The model proved customers would pay more for better experiences, encouraging competitors to launch their own integrated resort projects. Billions were invested as cities and countries competed to host these resorts, drawn by jobs, tourism, and international prestige.

Adelson also redefined how the industry viewed business travel alongside leisure gaming. He showed that business travelers were valuable casino customers, leading others to build convention centers and business-focused resort features. This shift helped diversify revenue and reshape customer segmentation strategies across the global casino and hospitality sectors.

Conclusion: The Enduring Power of the American Dream

Sheldon Adelson’s rise—from selling newspapers in Boston to leading a $35 billion empire—is a true American Dream story. His life showed that in a society rewarding innovation and determination, birth circumstances don’t have to limit one’s future.

From a $200 loan to Singapore’s $5.5 billion Marina Bay Sands, Adelson’s career spanned seven decades of bold entrepreneurship. He founded nearly fifty businesses, revolutionized industries, and became one of the wealthiest people in recorded history.

More importantly, he proved success can mean improving lives, not just increasing personal wealth or influence.

Adelson’s story is powerful not only because of his triumphs, but also the personal and professional trials he overcame. He endured early failures, the 2008 financial collapse, and the tragic loss of his son to addiction.

Each setback became fuel for greater success, revealing a resilience that defined his extraordinary character.

The values driving Adelson’s career offer timeless lessons: challenge norms, take calculated risks, and persist through every adversity. He questioned conventions, pursued what others feared, and created experiences that changed industries and benefited communities worldwide.

For those inspired by impossible success stories, Adelson’s journey mirrors figures like Elon Musk, who also overcame extreme odds. Both saw opportunity where others saw problems and bet everything on their visions for the future. Visionary thinking, combined with relentless execution, allowed them to defy expectations and shape the modern world.

Adelson’s legacy goes beyond wealth—he embodied the promise that merit, effort, and courage can overcome any limitation. His life proves that anyone with enough vision and determination can not only change their path, but change the world.

The boy selling newspapers on Boston’s streets became a man who built icons and influenced global politics and diplomacy. In doing so, he showed the American Dream is still real for those bold enough to chase it fully.

His story reminds us that success is not just about reaching the destination, but about the journey itself—the willingness to take risks, learn from failures, and never stop believing that tomorrow can be better than today. In a world that often seems to limit possibilities, Adelson’s life stands as proof that with enough determination and vision, any dream can become reality.

- From Poverty to Billions: The Extraordinary Rise of Kirk Kerkorian

- From Poverty to Power: The Extraordinary Rags-to-Riches Journey of Oprah Winfrey

- From Bullied Dropout to Billionaire: The Extraordinary Rise of François Pinault

- From Orphanage to Empire: The Leonardo Del Vecchio Story

- From Desert Sands to Billion-Dollar Empire: The Extraordinary Journey of Mohed Altrad

Sources

- Forbes – Sheldon Adelson Profile

- Wikipedia – Sheldon Adelson

- Las Vegas Sun – “Las Vegas Sands: A big rise, a big fall”

- Newsweek – “Sheldon Adelson Gave Trump and Republicans Over $424 Million Since 2016”

- The New York Times – “Sheldon Adelson, Billionaire Donor to G.O.P. and Israel, Is Dead at 87”

For more inspiring stories of individuals who overcame extreme adversity to achieve massive success, visit The Phoenix Ascent and discover how ordinary people accomplished extraordinary things through determination, vision, and unwavering persistence.